"A green success story" - Interview with Raphael Fink from the Association for Consumer Information (VKI)

Raphael Fink is in charge of Guideline UZ 49 "Sustainable Financial Products" of the Austrian Ecolabel at the VKI on behalf of the Ministry of Climate Protection (BMK). In this interview he tells us what it is all about and why the label is such a great success.

Since when has the Ecolabel for Sustainable Financial Products been available? What was the background for the label?

The Austrian Ecolabel for Sustainable Financial Products (UZ 49) has been around since 2004, which makes it the oldest financial quality label in Europe. At that time, it was mainly the pension funds that were the driving force behind the development of a quality label in the fund sector - today, sustainable funds are also a big topic for private investors. In addition, the directive now also includes sustainable current accounts and savings accounts as well as green bonds, which finance green projects. Thus, there is something for every type of investor. The purpose of the label is to offer consumers orientation and at the same time to create trust in a financial product from a sustainability perspective.

How many companies have certified products and where can they be found?

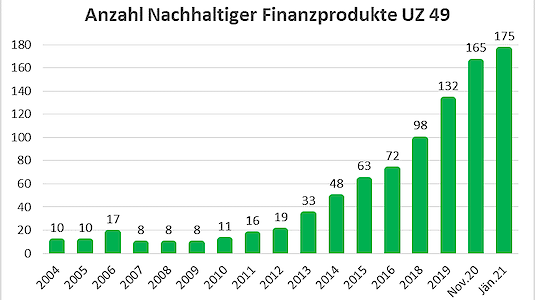

Currently, 53 companies have a total of 175 certified products. They can be found here. As the graph shows, there has been a very strong, very pleasing increase in the number of products certified with the Austrian Ecolabel, especially in the last four years. I am particularly pleased that there are already certified offers in the area of green bonds and sustainable giro and savings products. Here, private capital is used to finance sustainable projects, for example in the field of renewable energies or sustainable mobility - a very sensible and very necessary thing.

In your opinion, what is the greatest strength of the Ecolabel for Sustainable Financial Products? What are the major advantages?

The greatest strength of the Austrian Ecolabel for Sustainable Financial Products is its credibility. As it is a state quality label awarded on the basis of independent expert opinions, consumers can trust that the product is credible from a sustainability perspective. Exclusion criteria ensure, for example, that companies with non-sustainable core business (e.g. in the field of fossil energies or armaments) do not operate in an Ecolabel fund. Positive criteria guarantee a minimum level of ambition in the selection of securities or specify the areas in which green projects can be financed. Transparency criteria ensure that investors can get an up-to-date, comprehensive picture of the certified products.

How has the market developed in this area in recent years?

Green has long since ceased to be a niche - it has arrived in the mainstream. This will increase in the next few years for various reasons. On the one hand, because there is a general trend towards green products - whether it is financial products, cleaning products or electricity tariffs. On the other hand, because politicians, above all the European Union, have recognised that the financial industry can make a positive contribution to challenges such as the climate crisis by channeling money towards sustainability. By financing green projects, a change in the economy towards sustainability can be initiated. Green financial products will become even more mainstream - and the Austrian Ecolabel will continue to ensure that the wheat is separated from the chaff.

There are often reservations about environmentally friendly products - something to the effect that they do not perform as well as conventional products. What can be done to counter this?

It certainly does not apply to financial products. All studies show that sustainable investments perform better. This is shown by comparisons with conventional financial products. The Corona crisis has also confirmed this.

What should consumers generally look for when buying sustainable financial products?

I can only advise looking at the Austrian Ecolabel as a first step. Then, based on this pre-selection, I would look for additional information on the funds I am interested in - be it from a financial point of view, risk class or also from a further, more refined sustainability perspective. There are various tools for this - with Cleanvest, for example, you can very much refine your personal level of ambition. Stiftung Warentest also takes a close look at sustainable financial products. It is always worth taking a look at the providers' websites - transparency is always a good sign, and portfolio holdings should be available as up-to-date as possible.